Home

>

Business Check Ordering Guide > The Most Asked Electronic Business Checks Questions

The Most Asked Electronic

Business Checks Questions & Answers

You asked to know everything about electronic business checks, and we are delivering – right now! Here’s the complete guide to all your FAQs.

: There is a reason why most businesses these days opt for

laser checks. Not only are they the most effective and efficient way to pay your vendors and employees, they also maximize investments into existing accounting software like QuickBooks and Peachtree®/Sage 50. Leveraging the power of software, these compatible computer (laser) checks automatically track spending maintain vendor details, and create easy-access records, all saving SBOs time and money. checksforless.com® ensures that our computer checks are 100% compatible with existing software, in addition to being customizable for the business brand.

: Through our online ordering system, we get everything we need to ensure your checks are exactly right. checksforless.com® has a 100% financial institution compatibility guarantee. Our state of the art MICR matching system also ensures readability by all financial institutions.

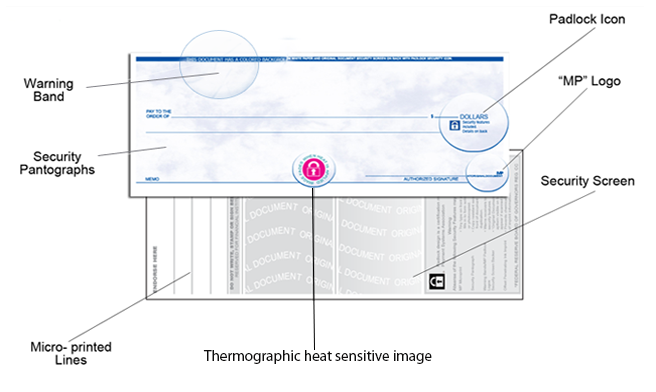

: At checksforless.com®, we guarantee your checks will meet or exceed industry bank processing standards, including Check 21 regulations. Check 21 is a federal law written to improve the efficiency and safety of the check processing system. Using electronic images, the need to physically transfer the check from one financial institution to another is eliminated. This system places certain requirements on the design, print quality and MICR encoding on banking products; a visual image is included below to best illustrate this:

All checksforless.com® checks exceed the security guidelines set by the industry and by the Check Payments Systems Association. For example, our checks feature security pantographs to limit reproducibility, as well as MicroPrinted Signature lines that are too small to be reproduced by a scanner.

: At checksforless.com®, we put the power of fully customizing your brand in your hands – and we do the work. We offer full customization on laser business checks, including 25 different color selections, a variety of fonts, and over 1,000 stock logos to choose from. Black logo imprinting is free of charge, but we can also prepare a quote for customized color logos.

: If you already have QuickBooks accounting software, you owe it to your business to get the most out of your investment. With a check writing add-on software (there are cloud-based options, too) you can easily write and print checks across multiple accounts, a key benefit for your business. Paired with QuickBooks compatible laser checks, you can centralize all your most important financial information, track (categorized) expenses, pay vendors, create invoices, and have clear financial records all in one place.

: This should be pretty seamless, but sometimes checks and deposits don't print the same for all users – due to specific printers and configurations. Just be sure to match-up your printer settings to get it right!

Order

Business Check

Online

: If you are already using an existing account software that has payroll functionality, your electronic checks can also help bring this improved system all together! Learn more about this

here.

: All checksforless.com® checks exceed the security guidelines set by the industry and by the Check Payments Systems Association. To safeguard your information against fraud, our site uses Secure SSL (Secure Sockets Layer) technology. Additionally, we use a secure server for all online transactions and have security checkpoints throughout in the ordering process. We further protect your personal and financial information through Enhanced Identity Lock Theft Protection (double verification) and 3rd party security validation, and we never share customer data with third parties. Lastly, checksforless.com® are members of the Better Business Bureau Online, an organization known for its expertise and experience in conducting successful national self-regulation programs.

: Laser checks pack a big punch! Here’s a few things they can help you out with:

- Avoid business check writing mistakes: From simple errors, to writing checks with insufficient funds, or opening yourself up to fraud with the wrong checks, these mistakes can be costly or embarrassing. Laser checks give you that safety net, ensuring everything is accurate, up-to-date, and fully tracked.

- Minimizing the chance for check account fraud: As a very real and costly threat to small businesses, laser checks help protect you from this crime. (Link to #9)

- Preventing fake business check scams: In addition to having secure laser checks at your side, you should also understand the ins and outs of check scams that may target your business and what to do about it. (Link to #10)

- 3rd-party check endorsements: While it may seem easy to sign a check over to someone else, we uncover why it’s best to keep your check systems clear-cut. (Link to #7)

- Tax-time hiccups: Laser checks, paired with your accounting software, eliminates the tax-time chaos and confusion that is a major pain point for many SBOs. (Link to #4)

: Visit us online at checksforless.com® or call us toll-free at 800-245-5775 to get started. While we already covered much of our FAQ page

here, our teams of experts are always happy to help you with any more specific questions you have along the way. checksforless.com® is also proud to offer a 100% satisfaction guarantee. When you order from us, you will get the exact high-quality checking supplies you need for your organization.

If you are ready to order your customized business checks that also can save you time and money, contact us today!

This article is made possible by Checksforless.com® For more than 35 years, Checksforless.com® has provided over 500,000 businesses with high quality business checks, deposit slips, and other banking supplies with easy ordering and fast production times; all at the guaranteed lowest price in the nation. Our discount business checks are easily customizable and compatible with over 4,500 software programs including QuickBooks and Peachtree/Sage 50. Email or call us toll-free at 800-245-5775.