Home

>

Business Check Ordering Guide > The Most Common Business Check Writing Mistakes

The Most Common Business

Check Writing Mistakes

Since business checks are an extension of your brand, you don’t want to tarnish your reputation with any mistakes or mishaps. It can actually be surprisingly easy to make a check writing mistake, especially in the current pace of our world, and there simply isn’t time for this headache. This quick guide will cover the most common business check writing mistakes so you can avoid them and keep your credibility (and your finances) intact.

- Having insufficient funds in your bank account: There is a difference between present balance (i.e. present-day ending balance; doesn’t include checks you’ve written but haven’t given to bank) and available balance (i.e. actual money available right now to use) and it can make all the difference if your check clears or not, so pay close attention to the reality of your funds. (⦁ L⦁ aser checks paired with accounting software like QuickBooks and Peachtree® can help provide clarity and accuracy).

- Failure to sign the check or signed it illegibly: You can’t forget to sign your check, and you can’t do a squiggle on the signature line to count. Both will bounce the check.

- Signing ahead of time: Never sign your check before filling out the payee and amount details; a blank signed check can expose you to fraud and theft.

- Incorrect details: Details matter here, so ensure everything is clear and accurate including the date, the payee, and amount (numerically and written form) otherwise your check could get flagged for suspicious content, resulting in a bounce. And, if you really mess up the check – start over with a fresh one to minimize confusion or processing issues.

- Stale-dated checks: When you issue a check, your payee needs to cash it within six months. Past this time limit, checks become stale-dated and won’t be honored at a later date. Furthermore, late deposits can make your own finances muddy, so remind recipients to cash it soon after it’s issued and stop the payment to avoid double cashing if the delay goes on too long.

- Post-dated checks cashed early: Don’t post-date a check because you always run the risk of a payee cashing it early without funds to cover it.

- Failure to spot check fraud:For more details on identifying and preventing check scams, check out our article here and to further protect your account from check fraud, access this supplemental guide here.

Order

Business Check

Online

Your business checks protect your business reputation, allow you to pay trusted vendors, and purchase items with confidence. This is why business check security features should be important to you, and it’s why they are so important to checksforless.com®.

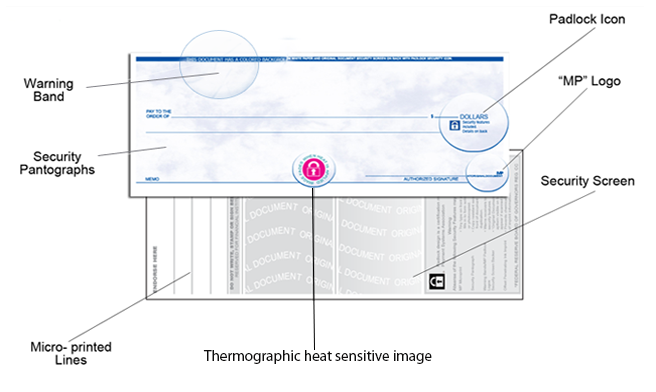

At checksforless.com®, we guarantee your checks will meet or exceed industry bank processing standards, including Check 21 regulations. Check 21 is a federal law written to improve the efficiency and safety of the check processing system. Using electronic images, the need to physically transfer the check from one financial institution to another is eliminated. This system places certain requirements on the design, print quality and MICR encoding on banking products; a visual image is included below to best illustrate this:

All our products have been tested to be fully compliant with Check 21, an important promise we are happy to make.

All checksforless.com® checks exceed the security guidelines set by the industry and by the Check Payments Systems Association. As two examples, our checks feature security pantographs to limit reproducibility, as well as MicroPrinted Signature lines that are too small to be reproduced by a scanner.

When you order checks (especially online), you are trusting that your provider will protect your most sensitive financial information – preventing vulnerabilities to theft and fraud. This is why it’s so important to choose the right provider that minimizes risk.

We know how important security is to our customers, and here’s our promises to your most frequently asked questions:

- What security features do you offer on your business checks? All checksforless.com® checks exceed the security guidelines set by the industry and by the Check Payments Systems Association.

- Is it safe to order business checks online? To safeguard your information against fraud, our site uses Secure SSL (Secure Sockets Layer) technology. Additionally, we use a secure server for all online transactions, have security checkpoints throughout in the ordering process, process credit cards through Address Verification Services, and our system checks for combinations of common elements of fraudulent orders (i.e. changes in the shipping address on reorders; different ship to, imprint and billing information; and deliveries to Post Office boxes and other non-physical addresses).

- How can I be sure that CFL is a reputable and trustworthy online business checks supplier? checksforless.com® are members of the Better Business Bureau Online, an organization known for its expertise and experience in conducting successful national self-regulation programs.

- When ordering business checks, will my financial information remain confidential? We protect your personal and financial information through Enhanced Identity Lock Theft Protection (double verification) and 3rd party security validation via an independent 3rd party whose certification is the only security scanning technology recognized to meet both the U.S. government's benchmark FBI/SANS security test and the security standards of all major credit card companies.

- Can anyone outside my business checks order see my personal information? checksforless.com® will never share customer information, including names and mailing addresses, with third parties.

Visit us online at Checksforless.com® or call us toll-free at 800-245-5775 to get started. While our

FAQ page is a great place to check out more information, our teams of experts are always happy to help you with any more specific questions you have along the way. Checksforless.com® is also proud to offer a 100% satisfaction guarantee. When you order from us, you will get the exact high-quality checking supplies you need for your organization.

If you are ready to order your customized business checks that are built with safety and protect your business reputation, contact us today!

This article is made possible by Checksforless.com® For more than 35 years, Checksforless.com® has provided over 500,000 businesses with high quality business checks, deposit slips, and other banking supplies with easy ordering and fast production times; all at the guaranteed lowest price in the nation. Our discount business checks are easily customizable and compatible with over 4,500 software programs including QuickBooks and Peachtree/Sage 50. Email or call us toll-free at 800-245-5775.