The business check is a huge (and important) part of your business. It’s how you receive payments, and it’s how you issue them.

How to endorse a business check is an essential and often overlooked detail to the check writing process and you’ll want to get this right. Luckily, we have everything you need to know right here – so let’s jump in.

Receiving checks: Endorsing a business check for deposit

Checks are a great way for your business to get paid – and it’s easy for customers to pay you.

As an added bonus, you’ll avoid the costs of processing credit card payments (including the the possibility of credit card chargebacks) – and you’ll bypass the grey area of cash transactions that are more difficult to track.

Once you receive a check, it’s time to endorse it so you can deposit it into your business account. Since it’s a different process to endorse a business check vs. a personal check, we’ll walk through the super simple process to make sure you feel prepared.

How to endorse a business check:

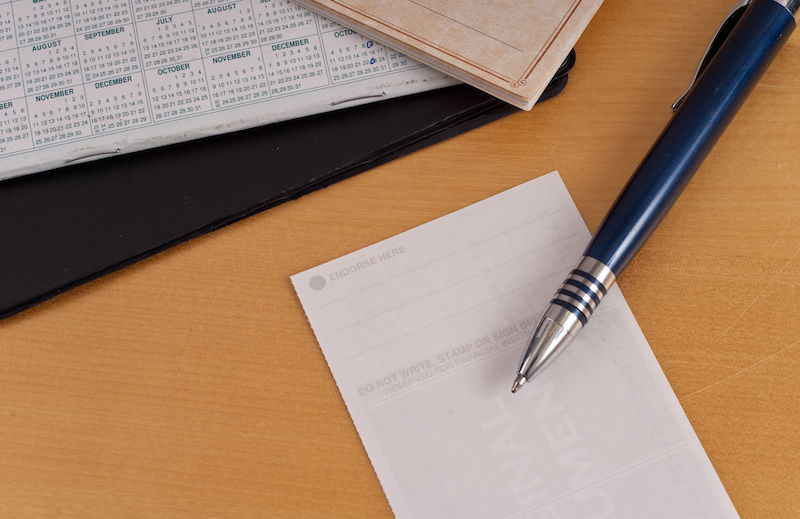

- Flip the check over and spot the endorsement area on the back – the short section at the top that states “Endorse Here.” Grab a pen and complete the endorsement:

- Write the business name (matching the check payee name)

- Sign your name

- Include your title (e.g., President, Chief Financial Officer, Manager, etc.)

- Add any check restrictions you require

- A restrictive endorsement reduces your risk by limiting what happens to the funds after you endorse the check. The most common restrictive endorsement is “for deposit only to SPECIFIC account” – ensuring it only goes to you without being cashed.

If your business accepts a large volume of checks, endorsement stamps will save you a ton of time.

And – here’s how to endorse a business check to someone else:

Who can endorse a business check? You. And, if you want to sign your business check over to another person*, it becomes a third-party check, and that money will now belong to the new payee. You can do this through:

- Endorsement in full: This includes the instructions “pay to the order of” with your signature – signing the check over in full to the new payee.

- Blank endorsement: This includes your (the payee) signature but no other instructions.

- Restrictive endorsement: This includes the instructions “for deposit only” with your signature, making this check only viable for deposits – including if you want to include a specific account.

*Just because this is possible, you’ll likely find some red tape – thanks to (needed) banking and identification security regulations. Your best bet to is to deposit the original business check and issue a new check (from your account) to the new payee.

Issuing checks: Your turn to endorse business checks

As you issue checks to your vendors, you’ll now be the one to endorse business checks.

Above all, make sure your business checks come from your business account – not your personal account. It’s messy to blur the lines here – especially when it comes to liability and financial records.

The best way to endorse business checks is to get good business checks to begin with. It’s why most businesses these days rely on laser checks since these maximize investments into existing accounting software like QuickBooks® and Peachtree®.

Checksforless.com has a 100% financial institution compatibility guarantee that your checks will meet or exceed industry bank processing standards, including Check 21 regulations, and these checks also exceed the security guidelines set by the industry and by the Check Payments Systems Association.

Laser checks not only make endorsement simple and secure, but you’ll also have access to real-time and powerful financial records thanks to the pairing of your accounting software – saving your business time and money.

Laser checks – better endorsements, better financial management

If you’re ready to order, visit us online at Checksforless.com or call us toll-free at 800-245-5775 to get started. While our Ultimate Business Checks Guide and FAQ page is a great place to check out more information, our teams of experts are always happy to help you with more specific questions you have along the way. We’re proud to offer a 100% satisfaction guarantee on all our checks, and we’re also happy to beat any lower price you find by 10%. Our quick turnaround time is 3-5 days with production – not including shipping time. We look forward to helping you with all your business and personal checking needs!

If you’re ready to order your customized laser checks (and stamps!) that streamline business check endorsement, contact us today!

This article is made possible by Checksforless.com. For more than 35 years, Checksforless.com has provided over 500,000 businesses with high quality business checks, deposit slips, and other banking supplies with easy ordering and fast production times; all at the guaranteed lowest price in the nation. Our discount business checks are easily customizable and compatible with over 4,500 software programs including QuickBooks® and Peachtree/Sage®. Email or call us toll-free at 800-245-5775.

References:

https://www.thebalance.com/endorse-a-check-to-your-business-315221

https://money.usnews.com/banking/articles/endorsing-a-check-the-right-way-at-the-right-time